Never-ending Gleevec Drug Price Increases Are Prime Example of Market Failure and Greed

Gleevec 400 mg tablets. photo adapted from [CC BY-SA 3.0], Patrick Pelletier via Wikimedia Commons

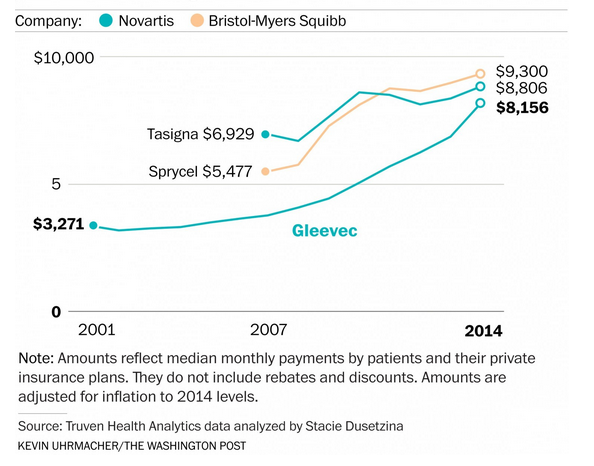

Not in the pharmaceutical industry, at least not until a drug goes off patent. The launch of therapeutically equivalent brand medications to treat CML actually coincided with Gleevec’s steepest price increases. Bristol-Myers Squibb launched Sprycel (dasatinib) in 2006 and Novartis launched a second generation drug called Tasinga (nilotinib) in 2007, both at much higher prices than Gleevec. In 2007, the monthly prices for Gleevec, Sprycel and Tasinga were $3,757, $5,477 and $6,929, respectively. The details can be found in the Post’s article but essentially Gleevec started to play “catch up” to its competitors.

In 2007, the price of Gleevec was 46% less than Tasinga. By 2014, the discount had shrunk to 12% with Gleevec’s price at $8,156/month compared to Tasinga’s price of $9,300/month. Let’s keep in mind that the newer drugs were shown to treat people that Gleevec could not treat, which would soften the argument that these are truly competing products. But soon after their introduction, Sprycel and Tasinga were found to successfully treat people with newly diagnosed cases of CML, to more directly compete with Gleevec, yet the latter’s price soared!

Source: Graph below from the Washington Post.

One source cited in the post’s article summed it up perfectly. A hematologist from the University of Chicago, Richard Larson, stated: “Ordinarily, you might think with three equally effective drugs on the market, the price should go down through competition, but it’s been a failure of the competitive pricing process.”

While the Washington Post’s article delved into the problem of out of pocket costs for Gleevec, it didn’t hammer home that the suffering in America is extreme when it comes to Gleevec’s drug price (and other medication prices as well). Gleevec is not a new topic on these blog pages, which has solicited comments from people and families crushed by drug costs. Yes, the irony is glaring: cancer medications that alleviate suffering also create suffering, too, in the form of cancer patients facing bankruptcy, feeling guilt, and causing anxiety.

It’s not just market failure – it is greed, too. I’ll let one American, Penny Kincaid, a commenter on this blog, bring it home:

Tagged with: Bristol Myers Squibb, chronic myeloid leukemia, Drug Prices, Gleevec, leukemia, novartis, Sprycel, Tasinga“I guess I am luckier than many on Gleevec. I am paying 5% of the cost each month but the cost keeps going up. Our lives depend on this drug but still the cost is obscene. They praise themselves for creating [these] drugs for patients with [CML] but still we are forced to pay and many go broke. It is the cancer patient who has to pay up or die and they keep raising the cost. This is just wrong in so many ways and here we have the creators wanting to deny us the generic because they want that big money to keep rolling in. They should be ashamed of themselves.”